CALL US 1(844) 410-1907

HARD MONEY LENDING CRITERIA

The first part of every successful fix and flip is finding the right real estate property.

That’s why we’ve created this easy, 5-point guide to help you find the “sweet spot” deal, which can give you the best chance at making money in real estate, while safeguarding your investment.

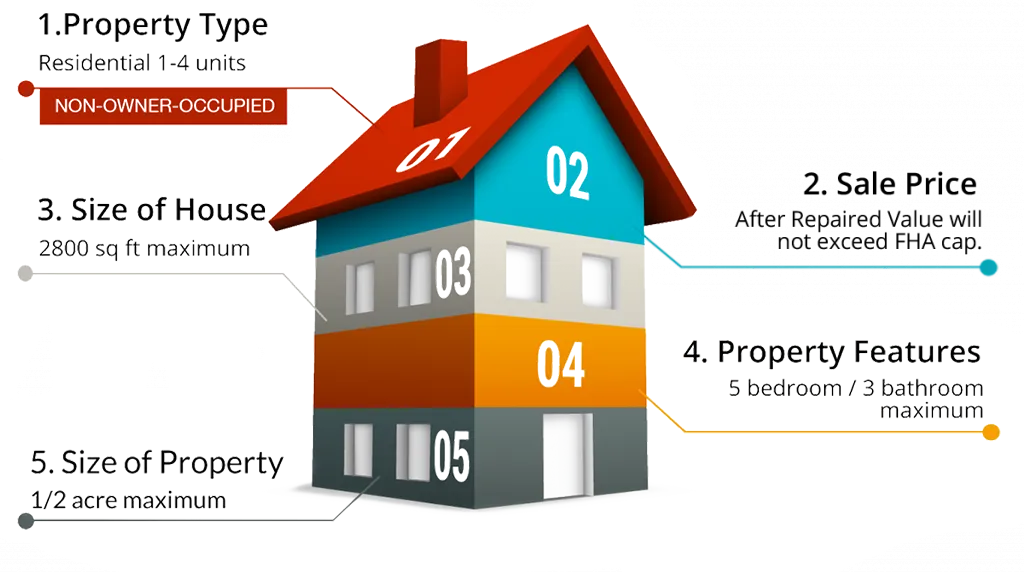

At Floyd Management Group, we are only interested in funding projects that will give you the best opportunity at realizing success. Therefore our criteria is centered around these 5 points:

*Higher credit scores (680+), and down payment (20% or more) trumps 3,4 and 5.2 Column

WHY THESE CRITERIA?

Why 1-4 Units

This is important. When you invest within these parameters, you can attract a larger segment of the market, including FHA buyers. This increases your ability to appeal to more people in more demographics.

Why price your home at or below FHA requirements?

FHA loans bring home ownership into reach for first-time home buyers who might have a hard time getting approved with conventional lenders. This increases your ability to sell your property faster and broadens your ability to attract more potential buyers.

Why a smaller home with no more than 5 bedrooms and 3 baths?

Millennials and Boomers are the two segments expected to dominate the market in the next five years. Both of these segments are looking at smaller homes: Millennials because they’re just starting out; Boomers because they’re downsizing. Candace Taylor of The Wall Street Journal wrote, “These days, buyers of all ages eschew the large, ornate houses… in favor of smaller, more modern-looking alternatives.”

Why less than 1/2 acre?

Both Boomers and Millennials are looking for less upkeep: Boomers because they’re getting older and Millennials because they’re just starting out. More acreage also means more expense.